Stock market tools for beginners can seem daunting, but scanners are a great place to start. These powerful tools can help you sift through thousands of stocks and pinpoint opportunities that match your criteria, making informed investment decisions easier. This guide will delve into the essentials of stock scanners, explaining how they work and how to use them effectively.

Understanding Stock Scanners

Stock scanners are essentially filters for the stock market. They allow you to define specific parameters, such as price, volume, technical indicators, and fundamental data, to narrow down your search and identify stocks that meet your investment strategy. Imagine trying to find a needle in a haystack; a stock scanner is like a powerful magnet that attracts only the needles, leaving the hay behind. They are crucial for quickly identifying potential investments, especially for beginners navigating the complexities of the market.

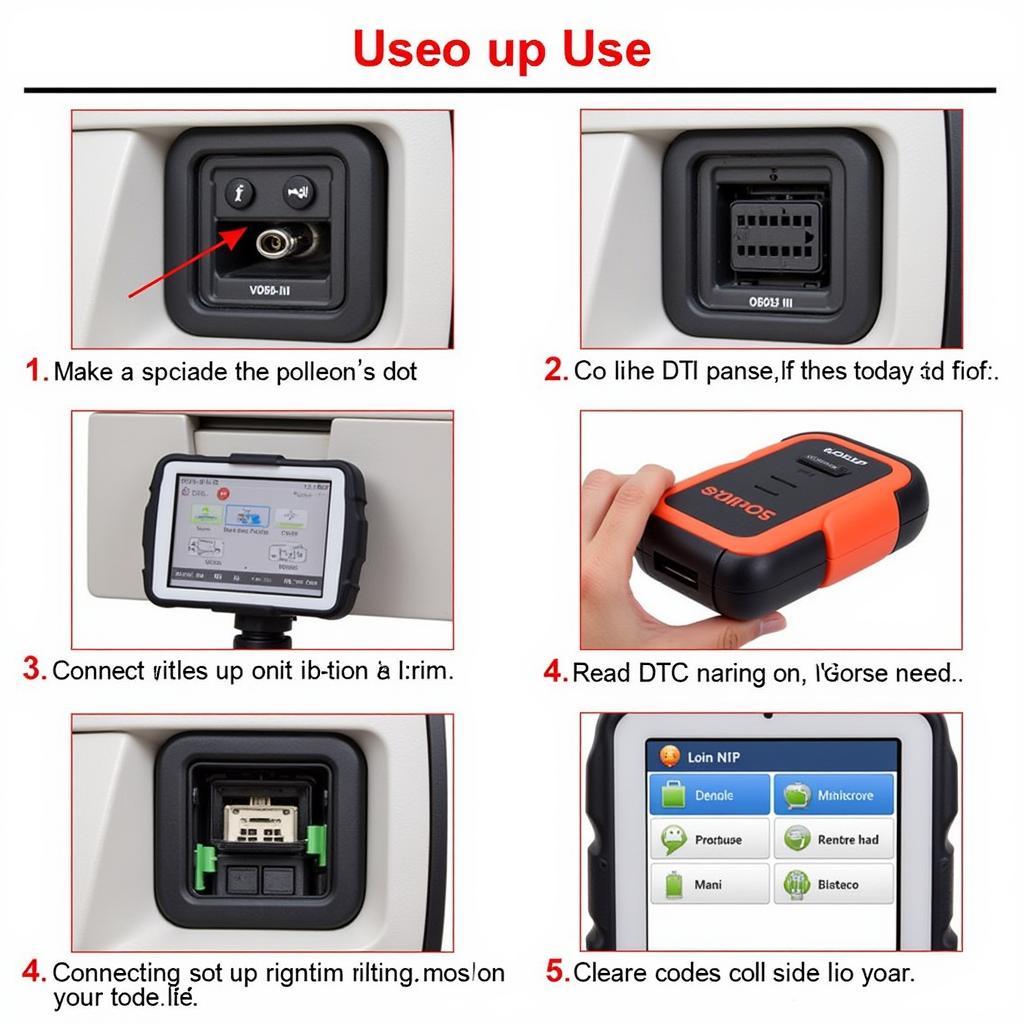

How Do Stock Scanners Work?

Stock scanners use algorithms to analyze real-time market data and filter stocks based on the criteria you set. You can specify factors such as price-to-earnings ratio, market capitalization, moving averages, and many other metrics. The scanner then generates a list of stocks that satisfy your requirements. Think of it as a custom search engine for the stock market, helping you quickly find the information you need.

Key Features of Stock Scanners for Beginners

For beginners, the sheer number of features offered by some scanners can be overwhelming. It’s important to focus on the essential features that will help you make informed decisions.

- Pre-built Scans: Many scanners offer pre-built scans based on common investment strategies, such as finding undervalued stocks or identifying stocks with high momentum. This is a fantastic starting point for beginners who are still learning the ropes.

- Customizable Criteria: The ability to customize your scan criteria is crucial as you gain experience. This allows you to refine your search based on your evolving investment strategy.

- Real-time Data: Access to real-time market data ensures that the scanner results are up-to-date, allowing you to react quickly to market changes.

- Alerts: Set up alerts to notify you when a stock meets your specified criteria. This can help you seize opportunities as they arise.

- Backtesting: Some scanners allow you to backtest your scanning criteria to see how they would have performed in the past. This can help you refine your strategy and avoid costly mistakes.

Customizable Stock Scanner Criteria for New Investors

Customizable Stock Scanner Criteria for New Investors

Choosing the Right Stock Scanner

With numerous stock scanners available, choosing the right one can be challenging. Consider factors like cost, ease of use, available features, and data quality. Some scanners are free, while others offer premium features with a subscription fee.

Free vs. Paid Stock Scanners

Free scanners are a good starting point for beginners, offering basic scanning capabilities. However, paid scanners often provide more advanced features, such as backtesting, real-time data, and more comprehensive charting tools. The best choice depends on your individual needs and budget.

Tips for Using Stock Scanners Effectively

- Start Simple: Don’t try to use every feature at once. Begin with basic criteria and gradually add more as you become more comfortable.

- Define Your Strategy: Before using a scanner, have a clear investment strategy in mind. This will help you choose the appropriate scanning criteria.

- Research Your Results: Don’t blindly trust the scanner results. Always conduct further research on the stocks that the scanner identifies.

“Stock scanners are powerful tools, but they shouldn’t replace fundamental analysis,” says John Miller, Senior Financial Analyst at Market Insights Group. “They are a starting point, not the finish line.”

Stock Market Tools for Beginners Scanner: Your Next Step

Stock market tools for beginners, particularly scanners, are invaluable for navigating the complexities of investing. By understanding how they work and using them effectively, you can significantly improve your investment decisions. Remember that scanners are just one piece of the puzzle. Combine their power with thorough research and a well-defined investment strategy for the best results.

“Don’t be afraid to experiment with different scanning criteria,” adds Maria Rodriguez, Investment Strategist at Global Wealth Management. “Finding the right combination for your strategy takes time and practice.”

Remember, we’re here to help! Connect with CARW Workshop at +1 (641) 206-8880 or visit our office at 4 Villa Wy, Shoshoni, Wyoming, United States.

FAQ

- What is a stock scanner? A stock scanner is a tool that filters stocks based on specific criteria, helping investors find potential opportunities.

- Are stock scanners free? Some scanners are free, while others offer premium features with a subscription.

- How do I choose a stock scanner? Consider factors like cost, ease of use, features, and data quality.

- Do I need a stock scanner as a beginner? Scanners can be extremely helpful for beginners, simplifying the process of finding investments.

- What are some common stock scanning criteria? Common criteria include price, volume, technical indicators, and fundamental data.

- Can I rely solely on stock scanners for investment decisions? No, always conduct further research before investing in any stock.

- Where can I learn more about using stock scanners? Many online resources and tutorials are available to help you master stock scanners.